Brazil Electrified Vehicles Maintain Growth and Consolidate at 8% Market Share

July 8, 2025 By ABVE

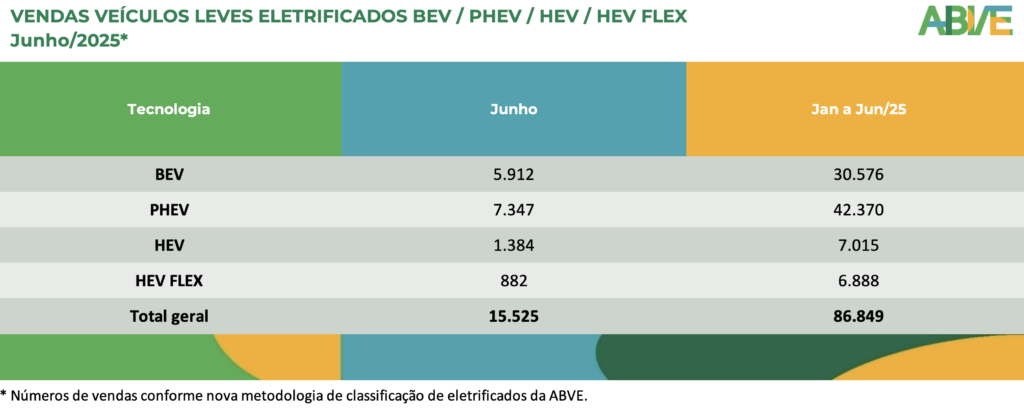

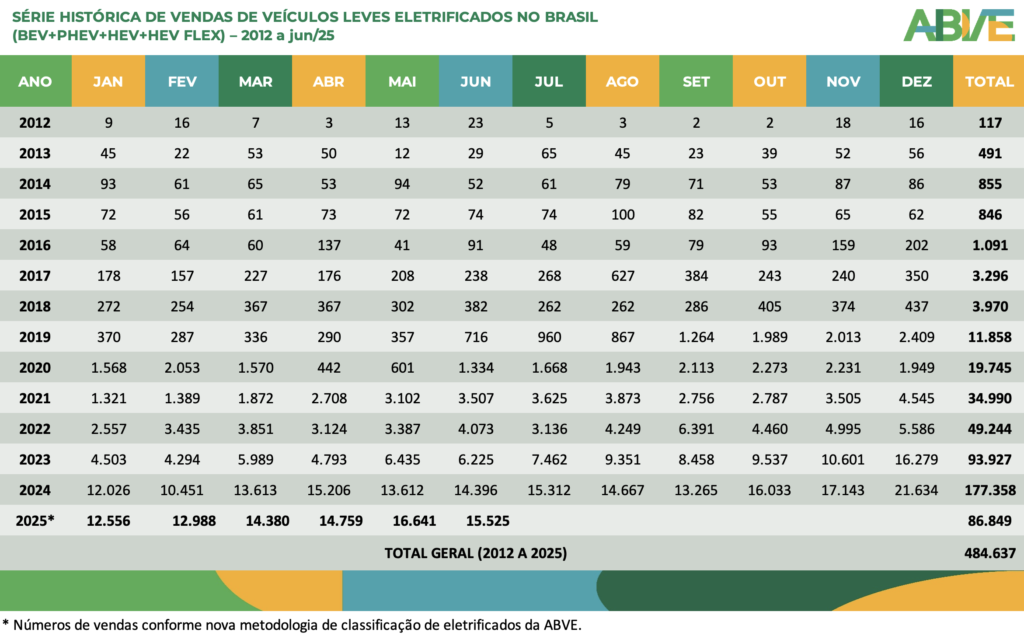

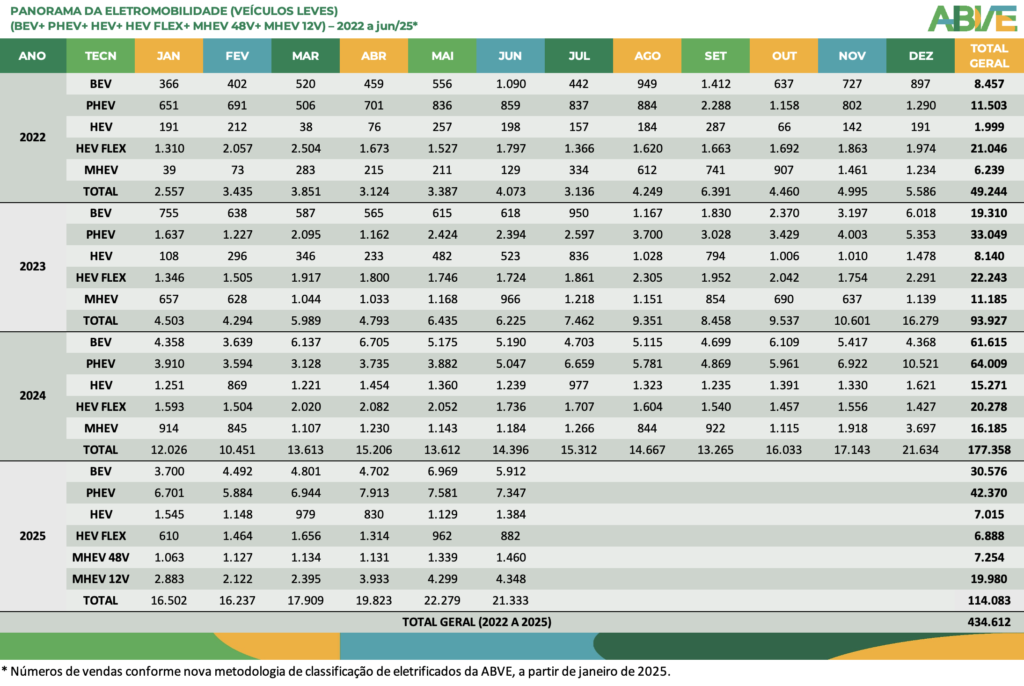

With 15,525 units sold in June, light electrified vehicle sales in Brazil reached 86,849 units in the first half of 2025, marking a 9.5% growth compared to the same period last year (79,304 units).

This sales growth solidifies electrified vehicles (BEV, PHEV, HEV, and HEV Flex) within the 8% range of Brazil’s total domestic light vehicle market (including passenger cars and light commercial vehicles).

“The numbers confirm the segment’s consolidation and the steady advance of electromobility in Brazil,” stated Ricardo Bastos, President of ABVE (Brazilian Electric Vehicle Association). “The sector continues to progress consistently, even amid increasing import taxes, and is poised to expand further with the imminent start of operations at Brazil’s first electric and plug-in hybrid vehicle factories in the coming weeks.”

Following 11 months after the second round of import tax increases for electrified vehicles in July 2024 (a third round took effect on July 1 this year), the segment demonstrates resilience and continues robust growth.

Between January and June 2025, 57 manufacturers operated in Brazil’s electrified vehicle segment, offering 293 electrified models. This represents significant growth compared to the same period in 2024, when 39 manufacturers offered 225 models.

The expansion was primarily driven by plug-in electric vehicles (BEV and PHEV), which surged from 187 models in H1 2024 to 253 in 2025. Hybrids also saw modest growth, increasing from 38 to 40 models.

This substantial increase in available electrified models reinforces the consolidation of electromobility in the country, providing consumers with more choices and intensifying competition among automakers. The progress highlights the industry’s commitment to the energy transition and points toward a more sustainable future for Brazilian mobility.

HIGHLIGHTS

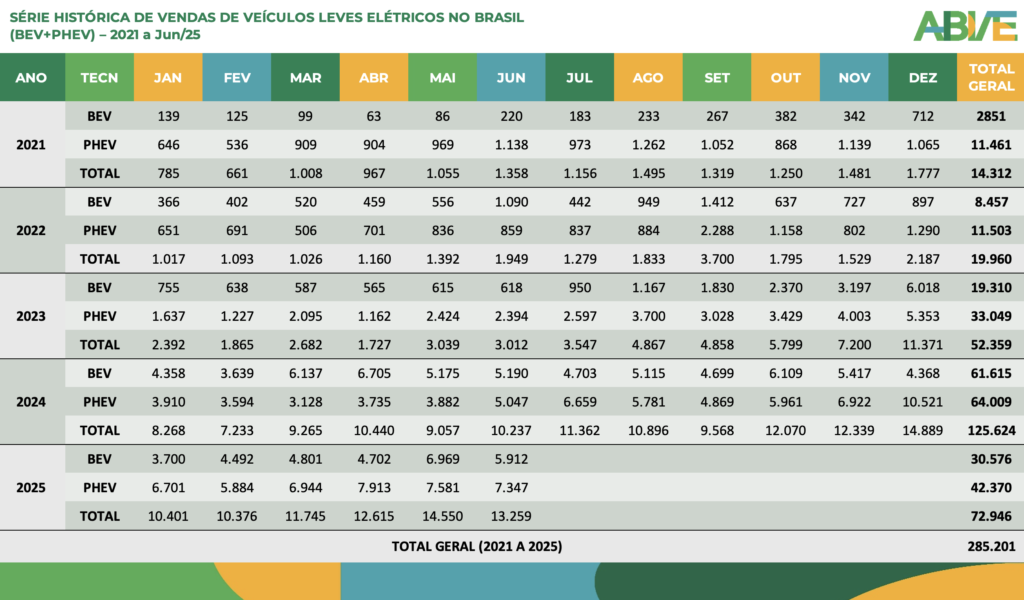

The standout of the semester were plug-in electric vehicles (with external battery charging), encompassing fully electric (BEV) and plug-in hybrids (PHEV). Plug-ins led the electrified market with 72,946 units sold from January to June.

This volume represents a significant 33.8% increase over the 54,500 plug-in vehicles sold in the same period of 2024.

Conversely, hybrids without external charging, including traditional hybrids (HEV) and flex hybrids (HEV Flex), had a more modest performance with 13,903 units sold – a 4% increase compared to 13,381 units in H1 2024.

The share of plug-in electric vehicles within total electrified sales grew substantially, jumping from 69% in H1 2024 to 84% in 2025. Meanwhile, hybrids lost ground, declining from 23.1% to 16% during the same period.

This shift reflects the growing preference among Brazilian consumers for externally rechargeable technologies, especially against the backdrop of expanding charging infrastructure nationwide.

JUNE PERFORMANCE

The 15,525 light electrified vehicles sold in June 2025 indicate a slight 6.71% contraction compared to May (16,641 units), but an 8% increase over June 2024 (14,396 units).

It is important to note that June 2024 figures included micro-hybrid models (MHEV). Given ABVE’s decision effective January 2025 to exclude MHEVs from the total count of electrified vehicles sold in the country, the semester’s growth would be even more impressive, around 17.5%.

Electrified vehicles (PHEV, BEV, HEV, HEV Flex) represented 8% of Brazil’s total light vehicle sales in June, within a market of 202,164 units sold (according to Fenabrave). This result reinforces the sector’s gradual growth trend amid the consolidation of electromobility in the Brazilian market.

In June 2025, plug-in electric vehicles maintained their leadership among electrified technologies in Brazil, accounting for 85.4% of segment sales with 13,259 units. HEV and HEV Flex hybrids accounted for the remaining 15% (2,266 units).

- Plug-in hybrids (PHEV): 7,347 units (47.3% of total). This represents a slight 3% decrease from May (7,581) but a significant 45.6% increase compared to June 2024 (5,047).

- Battery electric vehicles (BEV): 5,912 units (38.1% of total). Despite a 15.2% contraction from May (6,969), sales surpassed June 2024 volume (5,190) by 14%.

- Traditional hybrids (HEV): 1,384 units sold (8.9% of market). This represents a 22.6% increase from May (1,129) and an 11.7% increase from June 2024 (1,239).

- Flex hybrids (HEV Flex): 882 units (5.7% of market). Sales fell 8% from May (962) and showed a sharp 49% contraction compared to June 2024 (1,736).

Light Electrified Vehicles by Technology – June 2025:

PHEV: 7,347 (47.3%)

BEV: 5,912 (38.1%)

HEV: 1,384 (8.9%)

HEV FLEX: 882 (5.7%)

TOTAL: 15,525

Light Electrified Vehicles by Technology – H1 2025:

PHEV: 42,370 (48.8%)

BEV: 30,576 (35.2%)

HEV: 7,015 (8.1%)

HEV FLEX: 6,888 (7.9%)

TOTAL: 86,849

MICRO-HYBRIDS (MHEV)

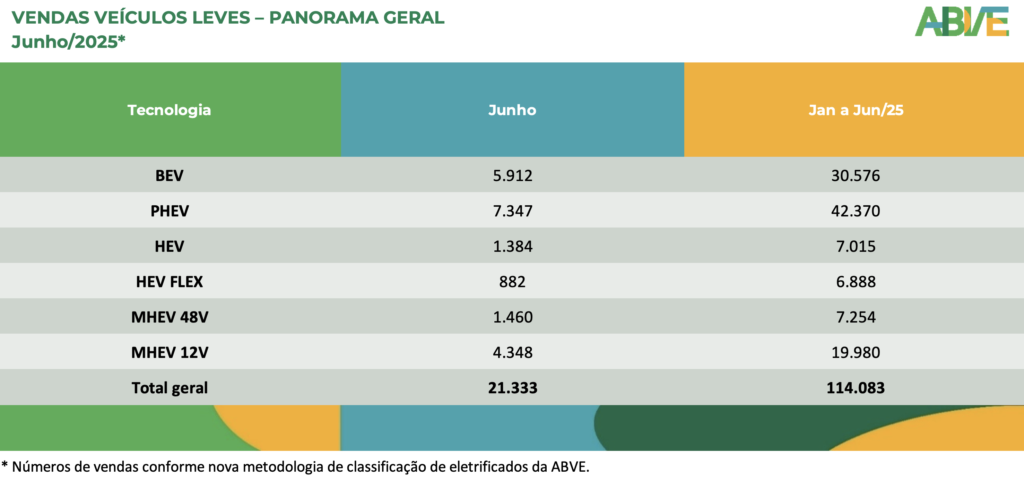

Micro-hybrids (MHEV) recorded strong expansion in June 2025, with 5,808 units sold. Compared to the same month in 2024 (1,184 units), growth was impressive: a 390.5% increase.

Within this group, models equipped with 12V MHEV systems led with 4,348 units (20.4% of total light vehicles? Context suggests MHEV market), showing a slight 1.14% growth from May (4,299). MHEV 48V totaled 1,460 units (6.8% of market), registering a 9% advance compared to May (1,339).

The arrival of new models with 12V MHEV technology since late last year reinforces the traditional automotive industry’s move towards intermediate mild-hybrid solutions, better aligned with emissions reduction targets. This shift signifies the gradual replacement of conventional fossil-fuel vehicles, including flex models, with vehicles featuring some degree of hybridization and electrification, albeit without electric traction.

However, since January 2025, ABVE decided that ABVE Data would only consider vehicles with electric traction and more robust batteries (including HEV, HEV Flex, PHEV, BEV) as electrified vehicles, excluding MHEVs.

GEOGRAPHY OF ELECTROMOBILITY

Electromobility is advancing gradually and steadily in Brazil, a process involving not only sales growth but also its dissemination across the national territory. A clear trend of sales “interiorization” is observed, reflecting greater capillarity of vehicle supply and charging infrastructure.

The Southeast region remains the absolute leader in the electrified market, responsible for 47% of sales in June 2025 (7,296 units). The state of São Paulo concentrates the largest volume, with an impressive 4,791 electrified vehicles in the month, representing 30.9% of the total national volume.

The South region also shows a strong national presence, accounting for 17.4% of total electrified sales (2,700 units), driven mainly by Paraná and Santa Catarina, each holding a 6% share of national sales. Combined, the Southeast and South regions accounted for 64.4% of electrified vehicle sales in June (9,996 units), highlighting the consolidation of electromobility in Brazil’s most industrialized regions.

Top 5 Municipalities – Light Electrified Vehicle Sales (June 2025):

1st – São Paulo: 2,095

2nd – Brasília: 1,578

3rd – Rio de Janeiro: 554

4th – Belo Horizonte: 533

5th – Curitiba: 420

Top 5 Municipalities – Light Electrified Vehicle Sales (H1 2025):

1st – São Paulo: 11,121

2nd – Brasília: 8,483

3rd – Belo Horizonte: 3,442

4th – Rio de Janeiro: 3,355

5th – Curitiba: 2,349